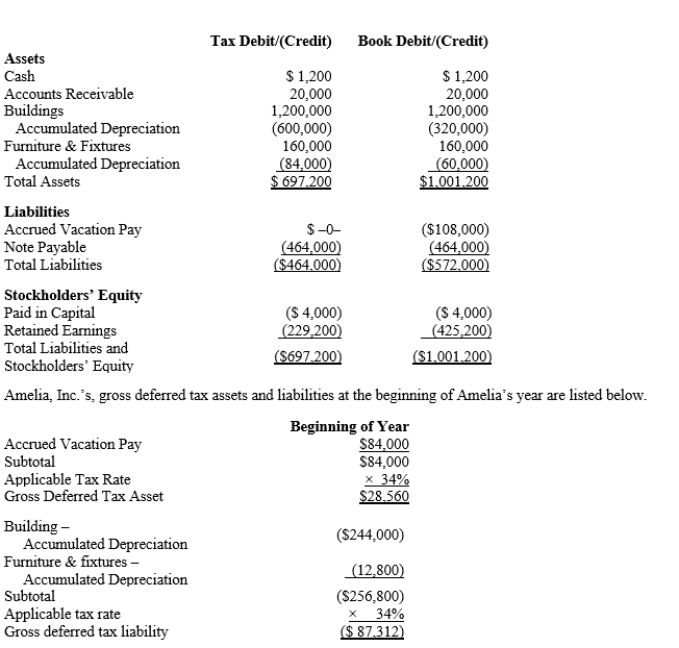

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.  Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.

Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.

It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and

entertainment expense.Determine the change in Amelia's deferred tax assets for the current year.

Definitions:

Longer Life Expectancy

An increase in the average period a person is expected to live.

Physical Fitness

The ability to carry out daily tasks with vigor and alertness, without undue fatigue, and with ample energy to enjoy leisure activities.

Health Issues

Conditions affecting physical, mental, or social well-being and potentially requiring medical treatment or intervention.

College Students

Individuals enrolled in institutions of higher learning, often pursuing undergraduate or graduate degrees.

Q7: Technical Advice Memoranda may not be cited

Q17: Subtitle A of the Internal Revenue Code

Q69: When accepting large capital projects, a company

Q81: On May 30, 2016, Jane purchased a

Q96: If actual direct material costs are greater

Q97: On January 1, Father (Dave) loaned Daughter

Q99: Sandra owns an insurance agency.The following

Q104: EKPN Co.produces wooden boxes.The company's standards per

Q112: The basis of cost recovery property must

Q114: Cold, Inc., reported a $100,000 total tax