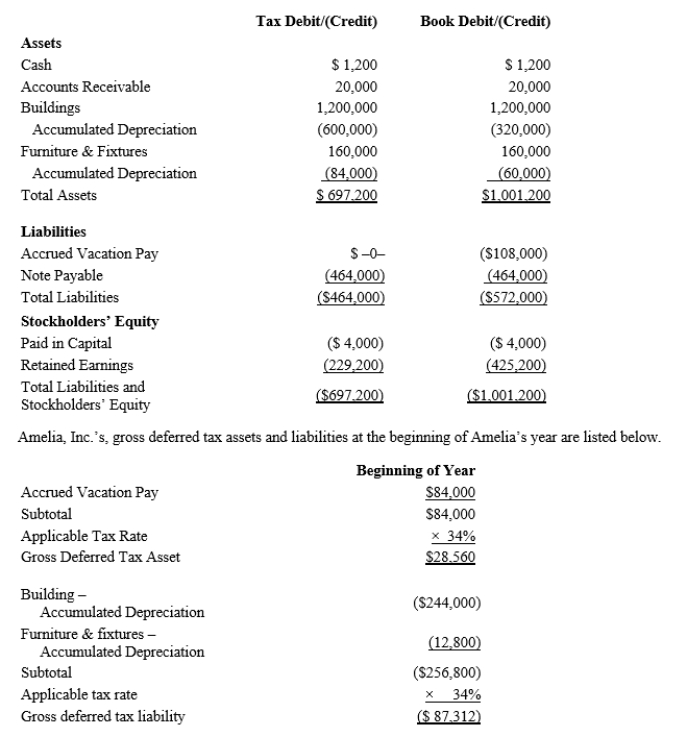

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.  Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.

Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.

It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and

entertainment expense.Determine the change in Amelia's deferred tax liabilities for the current year.

Definitions:

Fixed Interval

In the context of reinforcement schedules in psychology, a fixed interval schedule refers to the delivery of reinforcements after a specific, consistent amount of time has passed.

Dominant Hand

The hand that is most often used for tasks requiring precision and strength, typically the right hand for most people.

Involuntary Reflex Responses

Involuntary reflex responses are automatic, unintended movements or physiological responses mediated by the nervous system, often occurring in response to stimuli without conscious control.

Cerebral Cortex

The cerebral cortex is the outer layer of neural tissue of the cerebrum in the brain, playing a key role in memory, attention, perception, cognition, awareness, thought, language, and consciousness.

Q10: Yahr, Inc., is a domestic corporation with

Q28: Turner, a successful executive, is negotiating a

Q47: The overhead volume variance relates only to<br>A)variable

Q54: Sherri owns an interest in a business

Q69: In 2017, Emily invests $120,000 in a

Q73: If startup expenses total $53,000, $51,000 of

Q94: At the beginning of the year, Schrader,

Q120: Pablo, who is single, has $95,000 of

Q128: PaintCo Inc., a domestic corporation, owns

Q156: An expense need not be recurring in