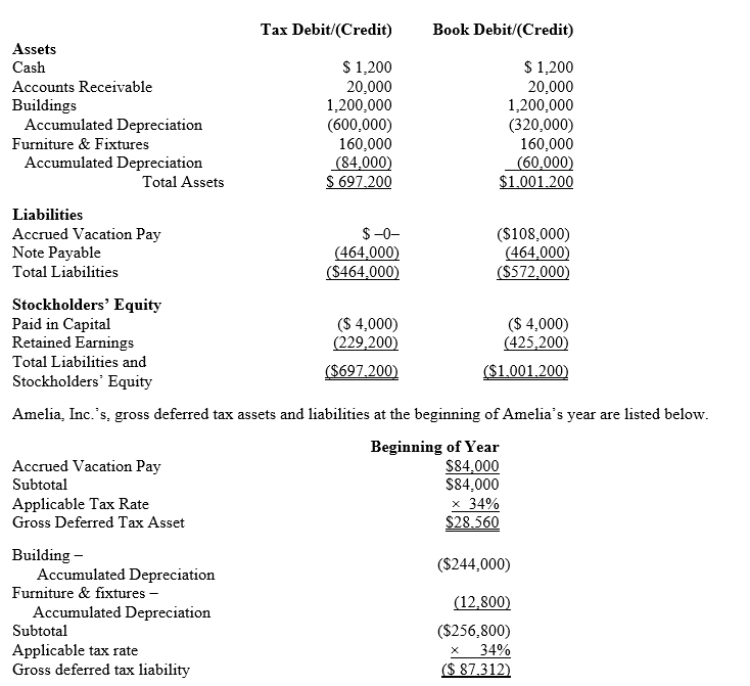

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.

Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.

It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and

entertainment expense.Determine the net deferred tax asset or net deferred tax liability at year end.

Definitions:

Endangered Species

Species that are at risk of extinction due to a dramatic decline in their population or habitat.

Flowering Plants

Plants that belong to the group Angiosperms, characterized by bearing flowers in which seeds are enclosed within a fruit.

Mammals

A class of warm-blooded vertebrate animals that possess hair or fur, and whose females produce milk for feeding their young.

Insects

Small arthropods belonging to the class Insecta, characterized by three-part bodies, usually two antennae, and compound eyes.

Q13: The total overhead budget variance is equal

Q21: Dunellon Company's actual sales results exceeded the

Q41: Discuss the criteria used to determine whether

Q65: Temporary Regulations are only published in the

Q70: Doris Co.is considering purchasing a new machine

Q80: Which, if any, of the following taxes

Q93: Doug and Pattie received the following

Q98: Book-tax differences can be explained in part

Q133: The amount of a loss on insured

Q147: Create, Inc., a domestic corporation, owns 90%