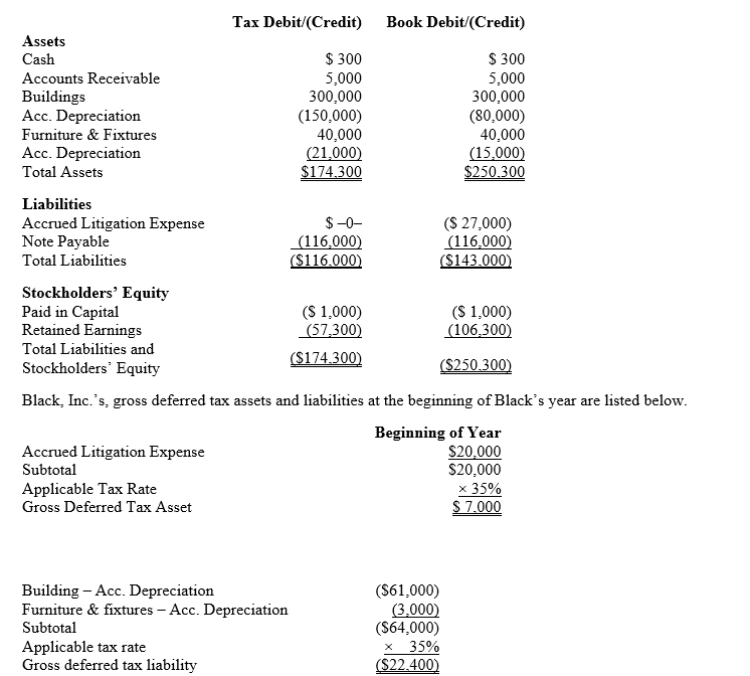

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals and entertainment expense.Provide the journal entry to record Black's current tax expense.

Definitions:

FIFO

An inventory valuation method where the first items placed in inventory are the first sold, standing for "First-In, First-Out."

Process Cost System

An accounting system used to apply costs to similar products that are mass-produced in a continuous fashion.

Shampoo Manufacturer

A company that specializes in producing and possibly formulating shampoos for cleaning hair and scalp.

Yield Measures

Financial metrics that represent the earnings generated and realized on an investment over a particular period, expressed as a percentage of the investment's cost or current value.

Q4: When using the cash payback technique, the

Q17: Maria, who owns a 50% interest in

Q28: The annual rate of return method is

Q35: Variance reports are<br>A)external financial reports.<br>B)Revenue Canada tax

Q39: Tom operates an illegal drug-running operation

Q57: The internal rate of return is the

Q62: In January, Lance sold stock with a

Q73: Taylor, a widow, makes cash gifts to

Q102: A baseball team that pays a star

Q123: South, Inc., earns book net income before