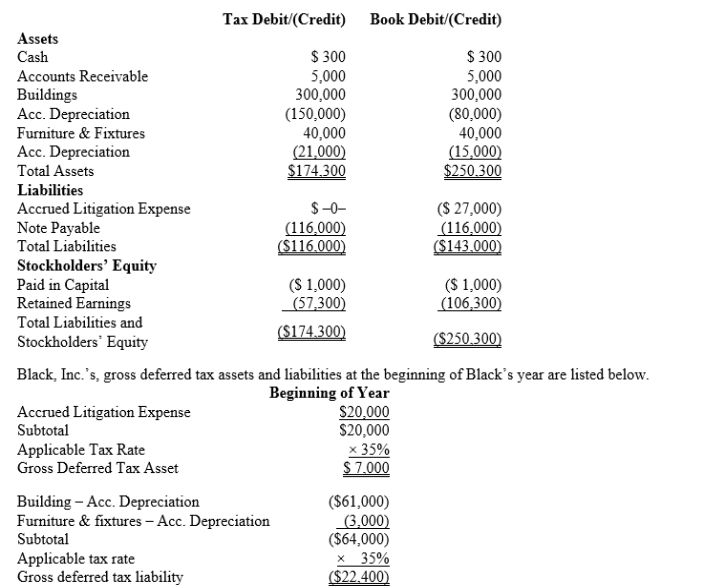

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.  Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals and entertainment expense.What is Black's total provision for income tax expense reported on its GAAP financial statement and its book net income after tax?

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals and entertainment expense.What is Black's total provision for income tax expense reported on its GAAP financial statement and its book net income after tax?

Definitions:

Meditation

A practice where an individual uses a technique, such as mindfulness or focusing the mind on a particular object, thought, or activity, to train attention and awareness, and achieve a mentally clear and emotionally calm and stable state.

Energy Flow

The movement of energy through a food chain or ecosystem, from producers through consumers and eventually to decomposers.

Traditional Chinese Medicine

A holistic medical system originating from China, utilizing practices such as acupuncture, herbal medicine, and Qi Gong to treat illness.

Ayurveda

The Indian system of medicine that views illness as a state of imbalance among the body’s systems.

Q29: The first codification of the tax law

Q36: On January 15, 2017, Vern purchased the

Q41: What is the purpose of determining return

Q46: If a company is concerned with the

Q65: Pat purchased a used five-year class asset

Q70: Doris Co.is considering purchasing a new machine

Q114: Cold, Inc., reported a $100,000 total tax

Q121: Describe the types of activities and taxpayers

Q126: The taxpayer should use ASC 740-30 (APB

Q167: Discuss the requirements in order for startup