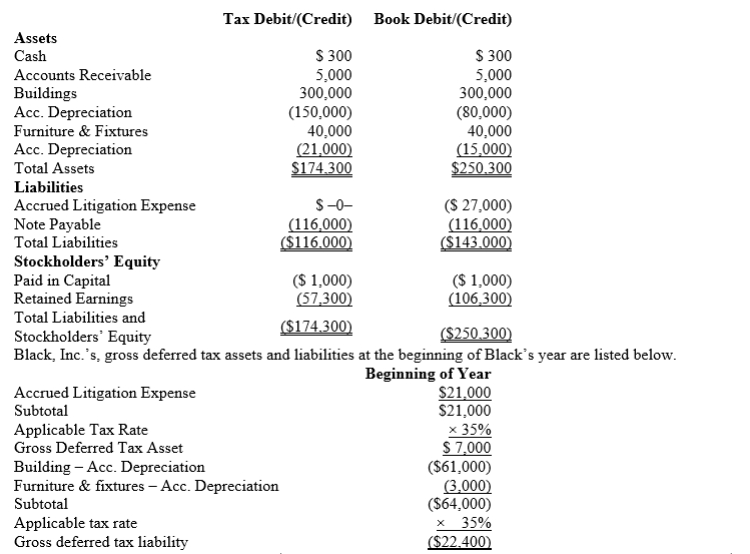

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.  Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals and entertainment expense.Provide the income tax footnote rate reconciliation for Black.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals and entertainment expense.Provide the income tax footnote rate reconciliation for Black.

Definitions:

Natural Causes

Reasons or factors that occur in nature and cause events or conditions without human intervention.

Statistical Process Control

The application of statistical methods to monitor and control a process to ensure that it operates at its full potential to produce conforming product.

Acceptance Sampling

A statistical quality control method that inspects a random sample of goods to decide whether the entire lot meets the predetermined standards.

Representative

An individual or entity that acts on behalf of others or an entire group, in a specific capacity or role.

Q3: The total standard cost to produce one

Q12: The Index to Federal Tax Articles (published

Q37: The principal objective of the FUTA tax

Q71: The fixed overhead spending variance is calculated

Q71: Which of the following is not a

Q76: Which, if any, of the following transactions

Q85: Determination letters usually involve completed transactions.

Q100: A deferred tax liability represents a current

Q102: When setting a flexible budget it is

Q112: Black, Inc., is a domestic corporation