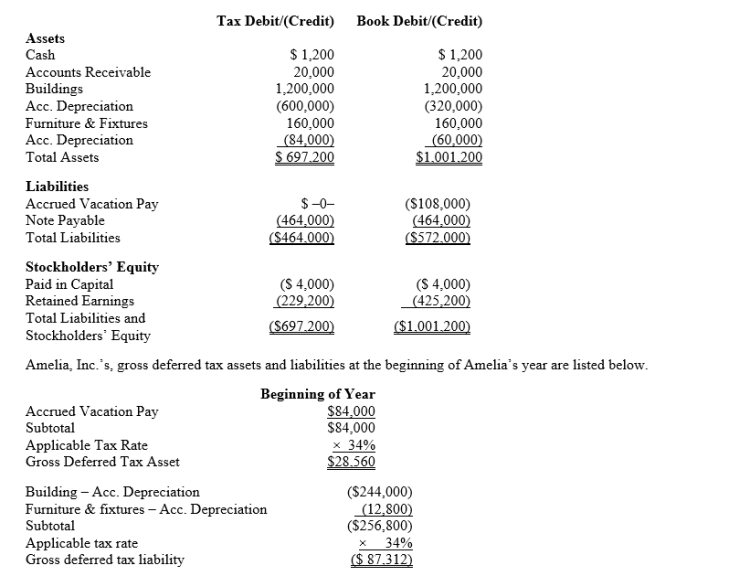

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.  Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Determine Amelia's change in net deferred tax asset or net deferred tax liability for the current year and provide the journal entry to record this amount.

Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Determine Amelia's change in net deferred tax asset or net deferred tax liability for the current year and provide the journal entry to record this amount.

Definitions:

16 PF Test

A psychological assessment tool that measures 16 personality factors or traits to understand human behavior.

Personal Orientation Inventory

A psychological assessment tool designed to measure personal self-actualization and intrapersonal values.

Inner Directedness

A personality trait where individuals are guided by their own values and standards rather than external expectations.

Self-Actualization

The process of realizing and expressing one's own capabilities and creativity, fulfilling potential and achieving personal goals at the highest level of Maslow's hierarchy of needs.

Q20: Julius, a married taxpayer, makes gifts to

Q26: In general, the purpose of ASC 740

Q30: As it is consistent with the wherewithal

Q38: In 2007, Terry purchased land for $150,000.In

Q52: If a corporation has no operations outside

Q54: The § 179 deduction can exceed $510,000

Q108: During 2016, the first year of operations,

Q114: During the current year, Ryan performs personal

Q148: South, Inc., earns book net income before

Q166: On May 2, 2017, Karen placed in