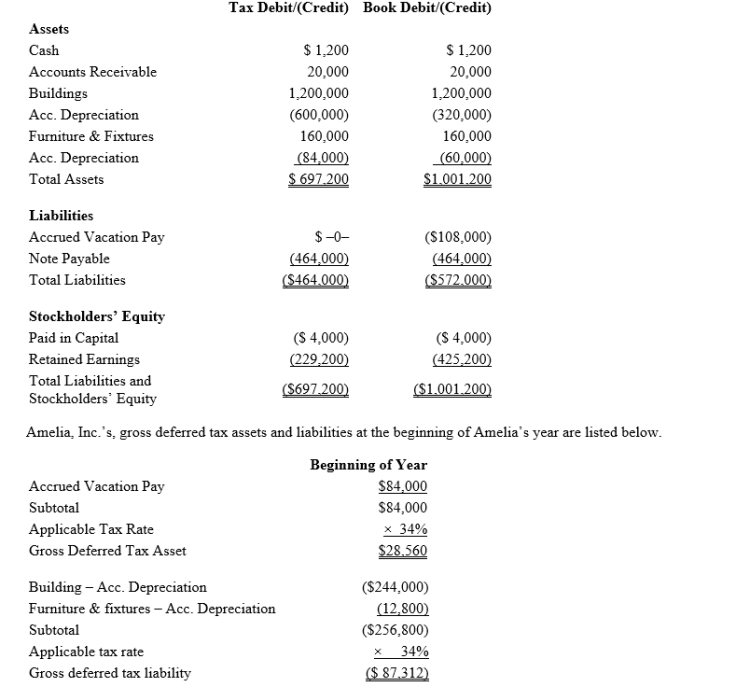

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.  Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Calculate Amelia's current tax expense.

Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Calculate Amelia's current tax expense.

Definitions:

Malnutrition

A condition that results from eating a diet in which one or more nutrients are either not enough or are too much, leading to health problems.

Sociocultural Causes

Factors in a person's cultural, social, and familial environment that contribute to the development of psychological disorders or behaviors.

Conduct Disorder

A mental health disorder characterized by a repetitive and persistent pattern of behavior in which the basic rights of others or societal norms are violated.

Coping Power Program

An intervention program designed to help children and adolescents manage aggressive behaviors and improve problem-solving skills.

Q6: Black, Inc., is a domestic corporation

Q7: A standard cost system may be used

Q13: Elk, a C corporation, has $370,000 operating

Q26: In addressing the importance of a Regulation,

Q29: The formula for the Federal income tax

Q51: Two persons who live in the same

Q81: Which one of the following is another

Q86: The cost of freight-in<br>A)is to be included

Q123: South, Inc., earns book net income before

Q159: George purchases used seven-year class property at