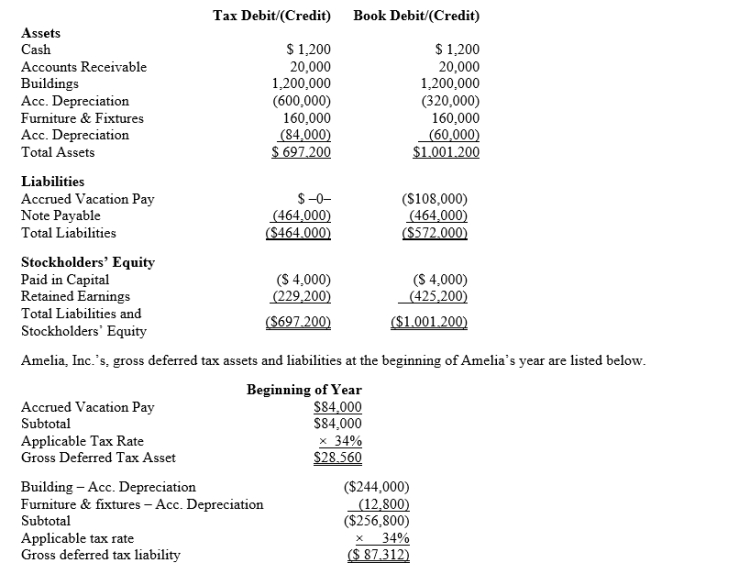

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.  Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Provide the journal entry to record Amelia's current tax expense.

Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Provide the journal entry to record Amelia's current tax expense.

Definitions:

Real Assets

Assets that have intrinsic value due to their substance and physical properties, such as real estate, commodities, or natural resources.

Current Account

A component of a country's balance of payments that measures the trade of goods and services, net earnings on investments, and transfer payments.

Goods Exports

The act of sending domestically produced goods to another country for sale or trade.

Current Account

A country's transactions with the rest of the world, including goods, services, income, and current transfers.

Q23: Not all of the states that impose

Q25: Which one of the following statements is

Q27: What was the direct materials quantity variance

Q50: Percentage depletion enables the taxpayer to recover

Q51: How does a graph of a flexible

Q56: On transfers by death, the Federal government

Q58: Texas is in the jurisdiction of the

Q63: Purple Corporation, a personal service corporation, earns

Q65: Gravel, Inc., earns book net income before

Q69: When accepting large capital projects, a company