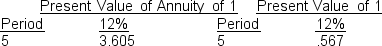

Tammy Co.is considering purchasing a machine that will produce annual savings of $22,000 at the end of the year.Tammy requires a 12% rate of return and the asset has a 5-year useful life.What is the maximum Tammy would be willing to pay for this machine?

Definitions:

Neurosis

A class of functional mental disorders involving chronic distress but neither delusions nor hallucinations, causing significant life impairment.

Karen Horney

A German psychoanalyst known for her theory of neurotic needs and her work on neurotic personality development.

Social Interaction Styles

Distinct patterns of communication and behavior used by individuals when engaging with others.

Inferiority

A feeling of lower status or adequacy in comparison to others, often associated with Erikson's stages of psychosocial development.

Q13: A thorough evaluation of how well a

Q16: Which of the following sources has the

Q17: The direct materials quantity standard should<br>A)exclude unavoidable

Q25: On January 1, 2017, Faye gave Todd,

Q26: Benny loaned $100,000 to his controlled corporation.When

Q41: Budgetary slack means<br>A)management delays the completion of

Q62: What legitimate reason might management have for

Q65: The matrix approach to variance analysis<br>A)will yield

Q119: Beach, Inc., a domestic corporation, owns 100%

Q172: South, Inc., earns book net income before