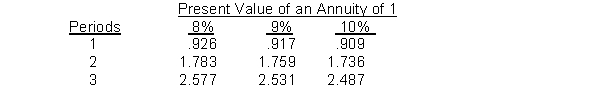

Use the following table for questions .

-A company has a minimum required rate of return of 9% and is considering investing in a project that costs $50,000 and is expected to generate cash inflows of $20,000 at the end of each year for three years.The profitability index for this project is

Definitions:

Awe

A feeling of reverential respect mixed with fear or wonder inspired by what is considered sublime or powerful.

Nirvana

In Buddhism, a transcendent state free from suffering and individual existence, achieved through enlightenment.

Humanistic Perspective

A psychological approach that emphasizes individual potential, self-growth, and the importance of viewing life and challenges from the person's subjective perspective.

Fully Functioning Person

A concept in humanistic psychology referring to an individual who lives in harmony with their deepest feelings and impulses.

Q31: The master budget contains which two classes

Q39: Tammy Co.is considering purchasing a machine that

Q49: A flexible budget is based on the

Q82: What effects do increases in plant assets

Q91: The management function that requires managers to

Q100: Once set, normal standards should not be

Q120: In the month of June, a department

Q121: Materials costs of $600,000 and conversion costs

Q130: In the month of June, a department

Q155: What might a very conservative sales budget