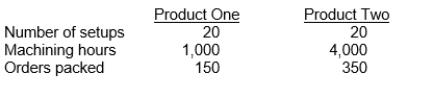

Canterra Co.incurs $160,000 of overhead costs each year in its three main departments, setup ($10,000) , machining ($110,000) , and packing ($40,000) .The setup department performs 40 setups per year, the machining department works 5,000 hours per year, and the packing department packs 500 orders per year.Information about Canterra's 2 products is as follows:  If machining hours are used as a base, how much overhead is assigned to Product One each year?

If machining hours are used as a base, how much overhead is assigned to Product One each year?

Definitions:

Sales Value

The total revenue attained from goods or services sold, calculated by multiplying the selling price by the number of units sold.

Absorption Costing

A costing method where all manufacturing costs, both fixed and variable, are allocated to products, thus "absorbing" them into the cost of goods sold.

Markup

The supplementary amount factored into the base price of goods to address fixed costs and earnings, influencing their final selling point.

Selling Price

The price a consumer disburses to obtain a product or service from a merchant.

Q10: In order to calculate the physical unit

Q14: Walton, Inc.is unsure of whether to sell

Q18: Budgetary slack means<br>A)management delays the completion of

Q22: Division B of the same company is

Q38: The application of the expected cash flow

Q45: Which statement is true concerning process cost

Q54: The total cost of a finished product

Q59: When monthly financial statements are prepared, where

Q65: The break-even point is the point at

Q66: Bitter Corporation accounts for its investment in