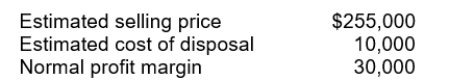

Walter Distribution Co.has determined its December 31, 2010 inventory on a FIFO basis at $240,000.Information pertaining to that inventory follows:  Walter records losses that result from applying the lower of cost and market rule.At December 31, 2010, the loss that Walter should recognize is

Walter records losses that result from applying the lower of cost and market rule.At December 31, 2010, the loss that Walter should recognize is

Definitions:

Particular Good

A specific item or product that satisfies consumers' needs or wants, distinguishable from general categories or types of goods.

Market Price

The current price at which an asset or service can be bought or sold in a market.

Production Possibilities Curve

A graphical representation that shows the maximum number of goods or services that can be produced using limited resources efficiently.

Technology Fixed

A scenario in economic models where the level of technology is assumed to remain constant, ignoring any potential technological advancements or changes.

Q1: The weighted-average accumulated expenditures on the construction

Q23: When expenses are presented by function in

Q36: The costs of land improvements with limited

Q37: An investment in an entity's debt instruments

Q38: Under a consignment sales arrangement,<br>A)the consignor receives

Q42: An organization chart in a manufacturing company

Q48: Which of the following should usually be

Q54: Revenue generally should be recognized<br>A)at the end

Q84: Under the fair value through other comprehensive

Q95: Which one of the following is most