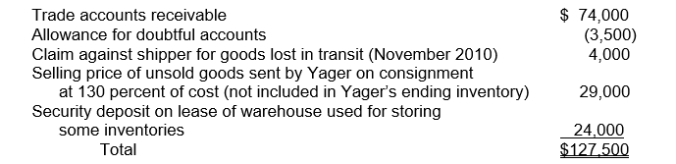

On the December 31, 2010 balance sheet of Yager Co., the current receivables consisted of the following:  At December 31, 2010, the correct total of Yager's current net receivables was

At December 31, 2010, the correct total of Yager's current net receivables was

Definitions:

IRR

The rate of return at which the sum of the present value of all cash inflows and outflows from an investment or project is zero.

MIRR

Modified Internal Rate of Return; a financial measure used to evaluate the attractiveness of investments, taking into account different financing costs and reinvestment rates.

Mutually Exclusive

Situations or events that cannot occur at the same time, indicating a choice must be made between them.

Required Rate of Return

Rephrased: The minimum percentage of profit or interest an investor expects from an investment to consider it worthwhile, factoring in the risk involved.

Q4: Which of the following does not describe

Q5: Which of the following does not correctly

Q12: Variable costs are fixed on a per-unit

Q21: Which of the following is not a

Q43: The new revenue recognition model currently studied

Q64: Which of the following is not required

Q79: How often should management receive or prepare

Q84: Firms that use large amounts of direct

Q90: If the parent company owns 90% of

Q94: Barger-Volvov Company had the following information at