Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

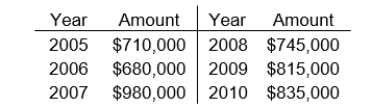

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

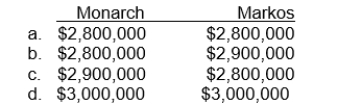

-Monarch Football Company had a player contract with Sidka that was recorded in its accounting records at $2.9 million.Markos Football Company had a player contract with Leber that was recorded in its accounting records at $2.8 million.Monarch traded Sidka to Markos for Leber by exchanging each player's contract.The fair value of each contract was $3 million.What amount should be shown in the accounting records after the exchange of player contracts?

Definitions:

Absorption Costing

An accounting method that assigns all manufacturing costs, both variable and fixed, to products, thereby impacting the inventory valuation on the balance sheet.

Net Operating Income

The profit a company makes from its operations, calculated as total revenue minus operating expenses, excluding taxes and interest.

Variable Costing

An accounting method that only includes variable production costs—direct materials, direct labor, and variable manufacturing overhead—in product costs.

Absorption Costing

A product costing technique that adds up all manufacturing expenses — direct materials, direct labor, variable, and fixed overheads — into the comprehensive cost of the product.

Q4: Assuming that Lock does not maintain perpetual

Q5: Making and collecting loans and disposing of

Q18: A change in the amortization rate for

Q18: Beaver Builders, Ltd.is using the completed-contract method

Q19: Meswell Corp.'s trademark was licensed to McCall

Q27: Garrison Company purchased a tooling machine on

Q50: In 2010, Frobisher Corporation reported net income

Q56: Identifying discontinued items is important if a

Q98: Under the equity method, revenue is recognized

Q128: Pattar's earnings per share for 2016 is<br>A)$25.00.<br>B)$20.00.<br>C)$3.00.<br>D)$2.50.<br>