Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

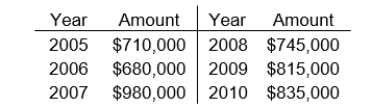

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

-During 2010, Kurz Company purchased the net assets of Sims Corporation for $635,000. On the date of the transaction, Sims had no long-term investments in marketable securities and had $200,000 of liabilities.The fair value of Sims' assets, when acquired were as follows:  How should the $365,000 difference between the fair value of the net assets acquired ($1 million) and the cost ($635,000) be accounted for by Kurz?

How should the $365,000 difference between the fair value of the net assets acquired ($1 million) and the cost ($635,000) be accounted for by Kurz?

Definitions:

Tricyclics

A class of antidepressant medications used to treat depressive disorders by affecting neurotransmitter levels in the brain.

Neurochemistry

The study of chemicals, including neurotransmitters and other molecules, that control and influence the nervous system.

Schizophrenics

People suffering from schizophrenia experience disruptions in their thinking, sensory perceptions, and actions, which identifies it as a mental health condition.

Incontinence

The lack of voluntary control over urination or defecation, leading to unintended loss of urine or feces.

Q5: Toledo Farms produced 180 tonnes of wheat

Q29: The cash total debt coverage ratio is

Q31: Greer Company's accounting records indicated the following

Q32: Bank overdrafts, if material, should<br>A)be reported as

Q34: The debit and credit analysis of a

Q43: The new revenue recognition model currently studied

Q49: Peskari Company's cost of goods sold and

Q99: An inventory method which is designed to

Q144: If the average collection period is 45

Q145: A high receivables turnover ratio may indicate