Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

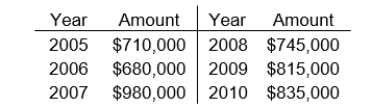

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

-During 2010, Kurz Company purchased the net assets of Sims Corporation for $635,000. On the date of the transaction, Sims had no long-term investments in marketable securities and had $200,000 of liabilities.The fair value of Sims' assets, when acquired were as follows:  How should the $365,000 difference between the fair value of the net assets acquired ($1 million) and the cost ($635,000) be accounted for by Kurz?

How should the $365,000 difference between the fair value of the net assets acquired ($1 million) and the cost ($635,000) be accounted for by Kurz?

Definitions:

Social Facilitation

The tendency for people to perform differently when in the presence of others than when alone, typically showing improvement in task performance.

Chameleon Effect

The chameleon effect refers to the unconscious mimicry of the postures, mannerisms, facial expressions, and other behaviors of one's interaction partners, facilitating social connection.

Role Playing

A technique in therapy and training where individuals assume roles and act them out in a controlled environment to explore behaviors and outcomes.

Philip Zimbardo

A psychologist known for conducting the Stanford prison experiment, which explored the effects of perceived power and authority on behavior.

Q1: An asset can be classified as held

Q10: Prepare the operating activities section of a

Q12: Which of the following statements regarding borrowing

Q14: Equity or debt securities held to finance

Q31: If the fair value of the net

Q39: The inventory turnover ratio is a measure

Q43: One objective of the income statement is

Q47: Which of the following items appears on

Q49: Which of the following statements best describes

Q53: Scott Company purchased equipment on November 1,