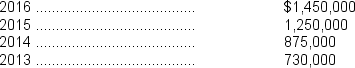

Assume the following sales data for a company:  What is the percentage increase in sales from 2015 to 2016?

What is the percentage increase in sales from 2015 to 2016?

Definitions:

Flat Tax

A tax system with a constant tax rate applied to all levels of income, opposing progressive tax systems where rates increase with income.

Tax Burden

The measure of the total amount of taxes that an individual or business must pay, expressed as a percentage of income or profits.

Average Tax Rate

The proportion of the total tax paid to the total taxable income, calculated by dividing the total tax amount by the taxable income.

Marginal Tax Rate

The percentage of tax applied to your income for each tax bracket in which you qualify, essentially the rate at which your last dollar of income is taxed.

Q8: A payment that is received would most

Q9: Dividends in arrears on cumulative preferred shares<br>A)never

Q20: Coombs Corp.declared a two-for-one stock split.Solly Fogarty

Q25: Which of the following criteria must be

Q34: Notes payable are sometimes used instead of

Q40: On December 1, Lambert Corporation exchanged 2,000

Q61: Depreciation accounting<br>A)provides funds.<br>B)funds replacements.<br>C)retains funds.<br>D)all of these.

Q94: Factors than can limit the usefulness of

Q123: Which one of the following is not

Q134: Which one of the following transactions does