Use the following information to answer questions

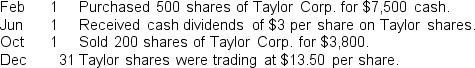

Wells Inc.reported these transactions relating to marketable trading investments intended to generate profits and to be sold in the near term:

-The entry, if any is required, to record the value of the investment on December 31 would include a debit to

Definitions:

Preparer Tax Identification Number

A unique identification number that all paid tax return preparers must use on U.S. federal tax returns or claims for tax refunds submitted to the IRS.

Marginal Tax Rate

The rate at which the last dollar of a taxpayer's income is taxed, indicating the rate of tax applied to your highest level of income.

Federal Tax Legislation

Laws passed by the United States Congress that relate to taxes imposed by the federal government.

Senate Finance Committee

A powerful committee in the United States Senate that deals with matters related to taxation, revenue, and other financial policies.

Q18: Under IFRS, the receipt of dividends from

Q20: Borrowing costs incurred for the acquisition of

Q28: An item of property, plant, and equipment

Q40: Management should select the depreciation method that<br>A)is

Q41: Best Baskets Limited (BBL) had a current

Q50: A successful grocery store would probably have<br>A)a

Q66: Which of the following is not an

Q87: On September 15, 2015, Spirit Ltd.sells 100

Q93: Which of the following is not considered

Q121: In performing a vertical analysis, the percentage