Use the following information to answer questions

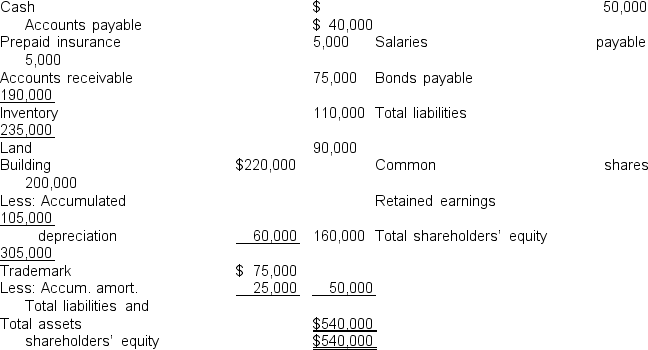

MARCOTTE MASONARY LTD.

Statement of Financial Position

December 31, 2015

-The total dollar amount of assets to be classified as net property, plant, and equipment is

Definitions:

Gross Pay

It's the total amount of compensation that an employee receives before any deductions, such as taxes and retirement contributions, are made.

FICA-OASDI

The portion of the U.S. Federal Insurance Contributions Act tax that funds the Social Security retirement, disability, and survivors' benefits.

Federal Income Tax

A tax levied by the federal government on the annual income of individuals, corporations, trusts, and other legal entities.

FICA Rate

The percentage of social security and Medicare taxes that must be paid by both employees and employers under the Federal Insurance Contributions Act.

Q9: What is the percent efficiency (E)of

Q19: An advantage of the corporate form of

Q23: Solve for i in A =

Q32: A sales invoice is prepared when goods<br>A)are

Q76: If total liabilities increased by $15,000 and

Q88: What is the additive inverse of -6?<br>A)0<br>B)-6<br>C)6<br>D)none

Q102: Which of the following uses accounting information

Q103: The double-entry accounting system records the dual

Q135: Generally, the revenue account for a merchandising

Q149: All long-lived assets including land have estimated