SCENARIO 5-7 There Are Two Houses with Almost Identical Characteristics Available for Available

SCENARIO 5-7

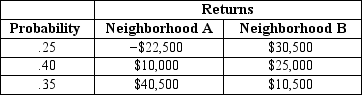

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition.The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Scenario 5-7,what is the expected value gain if you invest in both houses?

Definitions:

Cash Flows

The total amount of money being transferred into and out of a business, especially as affecting liquidity.

Derivative Security

A financial instrument whose value is based on the performance of an underlying asset, such as stocks, bonds, commodities, or currencies.

Financial Asset

Any asset that is cash, the right to receive cash or another financial asset, or an equity instrument of another entity, such as stocks, bonds, or derivatives.

Underlying Asset

An asset upon which a derivative’s price is based, such as stocks, bonds, commodities, or currencies.

Q6: Referring to Scenario 6-2,the probability is 0.45

Q7: A university dean is interested in determining

Q41: The time between arrivals at an intersection

Q61: Suppose Z has a standard normal distribution

Q81: What type of probability distribution will most

Q93: Referring to Scenario 7-4,90% of the samples

Q98: Referring to Scenario 3-3,the five-number summary of

Q128: Referring to Scenario 4-5,if a package selected

Q158: Referring to Scenario 5-9,what is the probability

Q185: Referring to Scenario 5-11,what is mean number