SCENARIO 5-7 There Are Two Houses with Almost Identical Characteristics Available for Available

SCENARIO 5-7

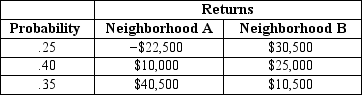

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition.The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Scenario 5-7,what is the total variance of value gain if you invest in both houses?

Definitions:

Go Long

The act of purchasing an asset with the expectation that its price will rise, reflecting an optimistic outlook on its future value.

Market Inefficiency

Situations where a stock's market price does not accurately reflect its true value, often due to a lack of information or irrational investor behavior.

Alpha

A measure of the excess return of an investment relative to the return of a benchmark index, indicating the investment’s performance against the market.

Mispricing

Mispricing refers to a situation where the market price of a security deviates from its true or intrinsic value due to factors like information asymmetry or market inefficiencies.

Q17: Referring to Scenario 3-7,what are the (absolute

Q42: Suppose that history shows that 60% of

Q81: Sampling error equals half the width of

Q95: Referring to Scenario 6-5,what is the probability

Q105: As the sample size increases,the standard error

Q108: You were told that the mean score

Q131: Referring to Scenario 8-4,a 99% confidence interval

Q148: The portfolio expected return of two investments<br>A)will

Q149: Which of the following statistics is not

Q165: The amount of tea leaves in a