SCENARIO 5-7 There Are Two Houses with Almost Identical Characteristics Available for Available

SCENARIO 5-7

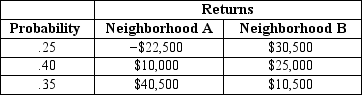

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition.The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Scenario 5-7,if you can invest 30% of your money on the house in neighborhood A and the remaining on the house in neighborhood B,what is the portfolio expected return of your investment?

Definitions:

Transitory Income

Income that is temporary or not expected to recur on a regular basis, affecting individuals' spending and saving decisions.

Permanent Income

A theory suggesting that an individual's consumption choices are more influenced by their lifetime average income rather than by their current income.

Advertising

A form of marketing communication used to promote or sell a product, service, or idea through various media channels to reach a target audience effectively.

Public Attitudes

The collective opinions, feelings, and perceptions of the general public or specific groups towards events, individuals, policies, or phenomena.

Q6: Referring to Scenario 4-9,if a company is

Q36: Referring to Scenario 7-5,the population mean of

Q44: The 12-month rate of returns over a

Q66: Referring to Scenario 6-2,the probability is 0.95

Q89: The closing price of a company's stock

Q103: Given below is the scatter plot of

Q140: Referring to Scenario 3-7,what is the skewness

Q152: The amount of time between successive TV

Q154: An investment consultant is recommending a certain

Q173: The interval between patients arriving at an