SCENARIO 5-7 There Are Two Houses with Almost Identical Characteristics Available for Available

SCENARIO 5-7

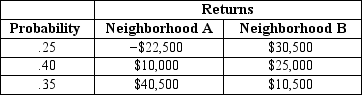

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition.The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Scenario 5-7,if your investment preference is to maximize your expected return and not worry at all about the risk that you must take,will you choose a portfolio that will consist of 10%,30%,50%,70%,or 90% of your money on the house in neighborhood A and the remaining on the house in neighborhood B?

Definitions:

Romanian Adoption Study

An influential research study investigating the effects of early institutionalization and subsequent adoption on child development.

Environmental Factors

External elements including social, physical, and biological aspects, that can influence an individual's health and behavior.

Psychosocial Functioning

An individual's ability to perform social roles in both interpersonal and societal settings, including emotional, social, and psychological capabilities.

Normalization Principle

The concept that individuals with disabilities or mental health issues should be entitled to live a life as close as possible to the norms and values of society.

Q26: You were told that the amount of

Q36: Suppose A and B are mutually exclusive

Q47: Referring to Scenario 4-9,set up a contingency

Q89: A quality control engineer is interested in

Q95: Referring to Scenario 7-4,the mean of all

Q161: Referring to Scenario 4-3,assume we know that

Q167: Referring to Scenario 3-3,the median number of

Q167: The addition of visual elements that either

Q168: The probability that a standard normal variable,Z,is

Q185: Referring to Scenario 5-11,what is mean number