SCENARIO 10-2

A researcher randomly sampled 30 graduates of an MBA program and recorded data concerning their starting salaries.Of primary interest to the researcher was the effect of gender on starting salaries.

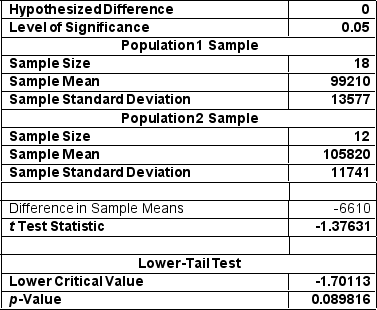

The result of the pooled-variance t-test of the mean salaries of the females (Population 1) and males (Population 2) in the sample is given below.

-Referring to Scenario 10-2,the researcher was attempting to show statistically that the female MBA graduates have a significantly lower mean starting salary than the male MBA graduates.Which of the following is an appropriate alternative hypothesis?

Definitions:

Retirement Savings Contributions Credit

A tax credit available to low and moderate-income individuals and families who contribute to qualified retirement savings accounts, aiming to encourage retirement savings.

Married Filing Joint

A tax filing status used by married couples who combine their income, exemptions, deductions, and credits on one tax return.

Lifetime Learning Credit

The Lifetime Learning Credit is a tax credit available in the United States for qualified tuition and related expenses paid for eligible students enrolled in an eligible educational institution, intended to promote post-secondary education.

Per Taxpayer

Refers to allowances, deductions, or credits applied on an individual basis for each taxpayer.

Q3: Referring to Scenario 11-8,the randomized block F

Q64: Referring to Scenario 10-3,which of the

Q67: Referring to Scenario 11-11,is there evidence

Q86: Referring to Scenario 12-7,there is sufficient evidence

Q89: The symbol for the confidence coefficient

Q101: Referring to Scenario 10-5,the p-value of the

Q134: Referring to Scenario 11-10,the mean squares for

Q144: Referring to Scenario 12-5,there is sufficient evidence

Q150: Referring to Scenario 9-5,the bank can conclude

Q170: Referring to Scenario 12-3,the expected cell frequency