SCENARIO 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500,then it is possible to reduce the variability of the portfolio's return.In other words,one can create a portfolio with positive returns but less exposure to risk.

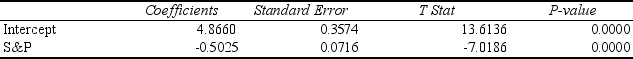

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons,which are believed to be negatively related to the S&P 500 index,is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index

(X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7,to test whether the prison stocks portfolio is negatively related to the S&P 500 index,the appropriate null and alternative hypotheses are,respectively,

Definitions:

Diminishing Returns

A rule that implies that after reaching a certain threshold, the profit rate from investing more into a specific sector won't keep rising unless there are changes in other contributing factors.

Production Function

An equation that describes the maximum output that can be achieved with a given set of inputs.

Labor

The use of human mental and physical efforts in the process of producing goods and offering services.

Average Total Cost

The average cost per unit of output, calculated by dividing the total production cost by the quantity of goods produced.

Q9: Referring to Scenario 13-8,the value of

Q35: Referring to Scenario 11-7,the randomized block F

Q51: Referring to Scenario 15-5,what is the value

Q58: Referring to Scenario 14-4,which of the independent

Q75: Referring to Scenario 13-5,the correlation coefficient is

Q112: Referring to Scenario 11-6,the among-group variation or

Q127: Referring to Scenario 13-13,the decision on the

Q135: Referring to Scenario 11-8,the null hypothesis for

Q148: Referring to Scenario 13-4,the managers of the

Q186: Referring to Scenario 14-17,which of the following