SCENARIO 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500,then it is possible to reduce the variability of the portfolio's return.In other words,one can create a portfolio with positive returns but less exposure to risk.

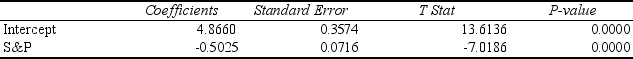

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons,which are believed to be negatively related to the S&P 500 index,is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index

(X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7,to test whether the prison stocks portfolio is negatively related to the S&P 500 index,the measured value of the test statistic is

Definitions:

Correlation Coefficient

A statistical measure that calculates the strength between two variables and their level of association, ranging from -1 to 1.

Sample Correlation Coefficient

A measure that quantifies the degree to which two variables change together, indicating the strength and direction of their linear relationship in a sample.

Test Statistic Value

A quantity derived from sample data and used in a hypothesis test to determine whether to reject the null hypothesis.

T-Table Values

Values found in a T-table are used to determine critical values of the t-distribution, helpful in hypothesis testing and constructing confidence intervals when the population standard deviation is unknown.

Q5: Referring to Scenario 11-10,at 1% level of

Q10: With four independent variables in a proposed

Q12: Referring to Scenario 13-11,the null hypothesis for

Q52: Referring to Scenario 12-1,what is the

Q56: Referring to Scenario 14-2,suppose an employee had

Q169: Referring to Scenario 13-8,the value of the

Q189: Referring to Scenario 14-17,what is the standard

Q201: Referring to Scenario 14-17,we can conclude definitively

Q206: Referring to Scenario 14-15,the null hypothesis<br>H<sub>1</sub>:

Q256: Referring to Scenario 14-13,holding constant the effect