SCENARIO 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500,then it is possible to reduce the variability of the portfolio's return.In other words,one can create a portfolio with positive returns but less exposure to risk.

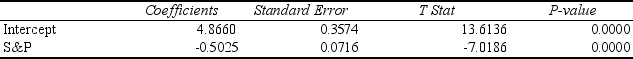

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons,which are believed to be negatively related to the S&P 500 index,is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y)on the returns of S&P 500 index

(X)to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7,to test whether the prison stocks portfolio is negatively related to the S&P 500 index,the p-value of the associated test statistic is

Definitions:

Conditioned Stimulus

A previously neutral stimulus that, after becoming associated with an unconditioned stimulus, evokes a conditioned response.

Unconditioned Response

A spontaneous, innate response to a stimulus that happens without any previous conditioning or learning.

Operant Conditioning

An approach to education that utilizes incentives and penalties to shape behavior.

Instrumental Conditioning

A learning process in which an individual alters behavior due to the association of actions with punishments or rewards.

Q27: Referring to Scenario 11-3,what should be the

Q32: Referring to Scenario 13-11,which of the

Q55: Referring to Scenario 11-8,it is appropriate to

Q61: The fairly regular fluctuations that occur within

Q144: A second-order autoregressive model for average mortgage

Q159: Referring to Scenario 16-5,the number of arrivals

Q206: Referring to Scenario 13-9,the estimated change in

Q210: Referring to Scenario 11-5,what is the value

Q219: Referring to Scenario 14-15,the null hypothesis should

Q221: Referring to Scenario 14-18, which of the