SCENARIO 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500,then it is possible to reduce the variability of the portfolio's return.In other words,one can create a portfolio with positive returns but less exposure to risk.

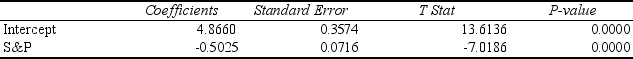

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons,which are believed to be negatively related to the S&P 500 index,is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index

(X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7,which of the following will be a correct conclusion?

Definitions:

Mobile Phones

Portable electronic devices used for communication purposes, including voice calls, text messaging, and internet access.

Consumer Prices

Prices paid by consumers for goods and services, which can be influenced by changes in supply and demand.

Profits

The financial gain achieved when the revenue from business activities exceeds the expenses, costs, and taxes needed to sustain the activity.

Productivity

The efficiency of production measured by the amount of output per unit of input.

Q21: Collinearity is present if the dependent variable

Q39: If the correlation coefficient (r)= 1.00,then<br>A)the Y-intercept

Q41: Referring to Scenario 11-2,the value of the

Q53: Referring to Scenario 14-15,what are the lower

Q56: Referring to Scenario 12-11,the test will involve

Q85: Referring to Scenario 14-8,the value of the

Q143: The residual represents the discrepancy between the

Q145: Referring to Scenario 11-3,the test is robust

Q149: Referring to Scenario 12-17,what is the critical

Q154: Referring to Scenario 13-4,the managers of the