SCENARIO 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500,then it is possible to reduce the variability of the portfolio's return.In other words,one can create a portfolio with positive returns but less exposure to risk.

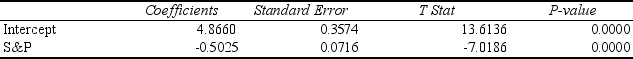

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons,which are believed to be negatively related to the S&P 500 index,is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y)on the returns of S&P 500 index

(X)to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7,to test whether the prison stocks portfolio is negatively related to the S&P 500 index,the p-value of the associated test statistic is

Definitions:

Cash Flows

The complete sum of funds flowing into and leaving a business, significantly impacting its liquidity.

Net Income

is the total earnings of a company after all expenses and taxes have been subtracted from total revenue; a key indicator of financial health.

Accrual Accounting

An accounting method where revenues and expenses are recorded when they are earned or incurred, regardless of when cash transactions occur.

Current Operating Liabilities

Short-term liabilities that are incurred as part of the normal operations of a business, due within a fiscal year.

Q12: Referring to Scenario 15-6,the model that includes

Q23: Referring to Scenario 12-13,if there is no

Q44: Referring to Scenario 14-17,what is the value

Q48: Referring to Scenario 13-11,the Durbin-Watson statistic is

Q53: Referring to Scenario 12-8,the calculated test statistic

Q58: In multiple regression,the _ procedure permits variables

Q151: A zero population correlation coefficient between a

Q206: Referring to Scenario 14-15,the null hypothesis<br>H<sub>1</sub>:

Q208: Referring to Scenario 13-4,the least squares estimate

Q232: The coefficient of multiple determination measures the