SCENARIO 13-10

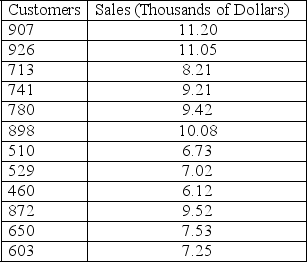

The management of a chain electronic store would like to develop a model for predicting the weekly sales (in thousands of dollars)for individual stores based on the number of customers who made purchases.A random sample of 12 stores yields the following results:

-Referring to Scenario 13-10,it is inappropriate to compute the Durbin-Watson statistic and test for autocorrelation in this case.

Definitions:

Expected Return

The anticipated return on an investment, calculated as the weighted average of all possible returns, weighted by the likelihood of each outcome.

Diversification

A risk management strategy that involves allocating portfolio resources or capital to a variety of investments to reduce exposure to any single asset or risk.

Diversification

The strategy of allocating investments among various financial assets or sectors to reduce risk.

Portfolio

A collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including mutual funds and ETFs.

Q12: Referring to Scenario 15-6,the model that includes

Q39: Referring to Scenario 16-4,exponential smoothing with a

Q54: A microeconomist wants to determine how corporate

Q66: Referring to Scenario 13-2,what percentage of the

Q89: Referring to Scenario 13-3,the regression sum of

Q122: Using the hat matrix elements h<sub>i</sub> to

Q123: Interaction in an experimental design can be

Q129: To assess the adequacy of a forecasting

Q155: Referring to Scenario 11-6,the null hypothesis for

Q215: Referring to Scenario 14-17,we can conclude definitively