SCENARIO 13-12

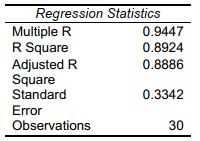

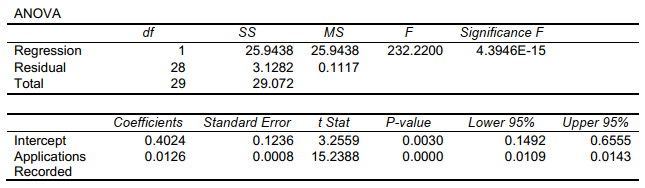

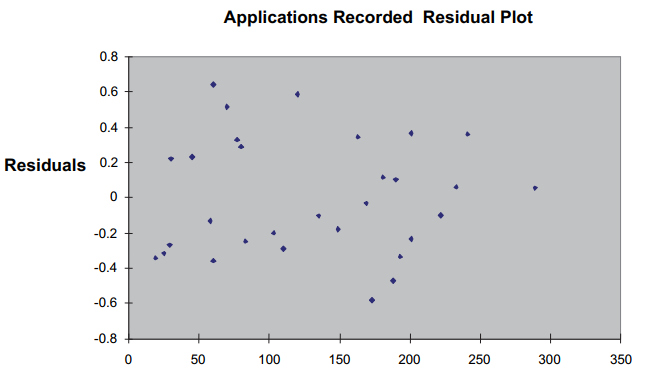

The manager of the purchasing department of a large saving and loan organization would like to develop a model to predict the amount of time (measured in hours) it takes to record a loan application. Data are collected from a sample of 30 days, and the number of applications recorded and completion time in hours is recorded. Below is the regression output:

-Referring to Scenario 13-12,the p-value of the measured t-test statistic to test whether the number of loan applications recorded affects the amount of time is .

Definitions:

Straight-Line Method

A depreciation method that allocates an equal portion of the initial cost of an asset to each period of its useful life.

Premium on Bonds Payable

The amount by which a bond's selling price exceeds its face value or par value, often resulting from interest rates lower than the bond's coupon rate.

Bonds Payable

Long-term liabilities representing money owed by an entity to bondholders, to be repaid at a specific future date.

Premium on Bonds Payable

The excess of a bond's sale price over its principal amount.

Q45: Referring to Scenario 16-9,if one decides to

Q48: Referring to Scenario 14-10,the proportion of the

Q76: Referring to Scenario 12-7,the critical value of

Q90: Referring to Scenario 14-2,for these data,what is

Q94: Referring to Scenario 12-7,the expected cell frequency

Q119: Referring to Scenario 14-3,the p-value for GDP

Q134: Referring to Scenario 16-11,using the second-order model,the

Q155: Referring to Scenario 13-9,the degrees of freedom

Q163: Referring to Scenario 14-15,there is sufficient evidence

Q168: Referring to Scenario 13-3,the director of cooperative