SCENARIO 14-4

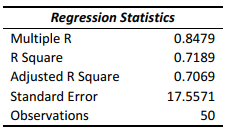

A real estate builder wishes to determine how house size (House) is influenced by family income (Income) and family size (Size) . House size is measured in hundreds of square feet and income is measured in thousands of dollars. The builder randomly selected 50 families and ran the multiple regression. Partial Microsoft Excel output is provided below:

Also SSR (X1 | X2) = 36400.6326 and SSR (X1 | X2) = 3297.7917

-Referring to Scenario 14-3,to test whether aggregate price index has a positive impact on consumption,the p-value is

Definitions:

State

A political entity that possesses sovereignty over a geographic area and the people within it, with a structured system of governance.

U.S. Tax System

A structured framework by which the federal, state, and local governments in the United States collect taxes from individuals and businesses based on income, sales, property, and other financial activities.

Primary Federal Tax System

The principal tax collection mechanism of the federal government, including income, payroll, and corporate taxes.

Primary State

The initial or foundational level of government authority in a country, often responsible for key areas such as law enforcement and taxation.

Q22: Referring to Scenario 16-13,you can conclude that

Q30: Referring to Scenario 12-9,at 5% level of

Q77: Some consider gauges little more than examples

Q107: Referring to Scenario 16-6,the forecast for sales

Q108: Referring to Scenario 14-3,to test for the

Q109: Referring to Scenario 13-4,the regression sum of

Q139: Referring to Scenario 16-12,to obtain the fitted

Q175: Referring to Scenario 12-6,the null hypothesis cannot

Q175: Referring to Scenario 13-10,the value of the

Q210: Referring to Scenario 13-11,what is the value