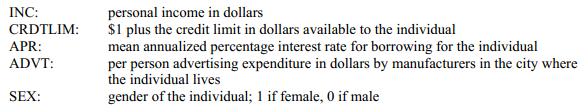

To explain personal consumption (CONS) measured in dollars,data is collected for

A regression analysis was performed with CONS as the dependent variable and CRDTLIM,APR,ADVT,and SEX as the independent variables.The estimated model was

? = 2.28 - 0.29 CRDTLIM - 5.77 APR + 2.35 ADVT + 0.39 SEX

What is the correct interpretation for the estimated coefficient for SEX?

Definitions:

Healthy Mississippi

An initiative or focus aimed at improving the health and wellbeing of the population in the state of Mississippi through various programs and policies.

Health Coverage

Insurance or other financial protection against medical costs, often provided by employers, government programs, or individual policies.

Ebola Patient

An individual diagnosed with Ebola virus disease, a serious and often fatal illness that can affect humans and primates.

NIH Clinical Center

The clinical research hospital of the National Institutes of Health (NIH), focusing on advanced patient care, clinical research, and the development of new medical treatments and procedures.

Q6: Referring to Scenario 12-6,what is the expected

Q45: Referring to Scenario 13-4,the managers of the

Q52: The LogWorth statistic is a measure of

Q61: Referring to Scenario 14-13,the predicted demand in

Q63: Collinearity will result in excessively low standard

Q75: Referring to Scenario 16-10,the value of the

Q103: Data on the amount of time spent

Q115: Referring to Scenario 13-2,what is the estimated

Q141: Referring to Scenario 13-5,the value of the

Q170: Referring to Scenario 14-9,the value of adjusted