SCENARIO 14-17

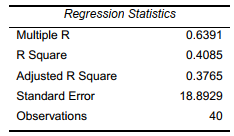

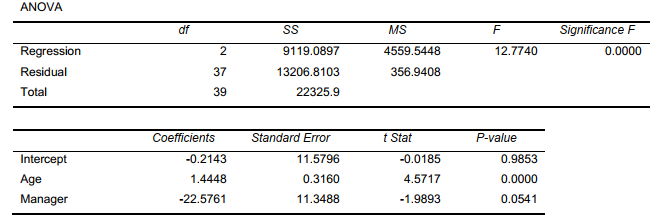

Given below are results from the regression analysis where the dependent variable is the number of weeks a worker is unemployed due to a layoff (Unemploy)and the independent variables are the age of the worker (Age)and a dummy variable for management position (Manager: 1 = yes,0 = no).

The results of the regression analysis are given below:

-Referring to Scenario 14-17,the null hypothesis

H0: 1= 2=0implies that the number of

weeks a worker is unemployed due to a layoff is not affected by any of the explanatory variables.

Definitions:

Present Value

The immediate worth of a prospective sum of money or sequence of cash flows, with a defined yield rate factored in.

Market Rate Of Interest

The prevailing rate of interest observed in the marketplace for securities or loans, influenced by factors such as supply and demand, inflation, and monetary policy.

Renewable Resources

Natural resources that can be replenished naturally over time, such as solar energy, wind, and biomass.

Nonrenewable Resources

Natural resources that cannot be replenished at the same rate at which they are consumed.

Q14: An interaction term in a multiple regression

Q40: Referring to Scenario 14-4,one individual in the

Q47: Referring to Scenario 16-13,what is your forecast

Q51: Referring to Scenario 15-5,what is the value

Q59: Referring to Scenario 14-1,for these data,what is

Q83: Successful implementation of a classification tree requires

Q118: Referring to Scenario 13-11,the normality of error

Q123: Referring to Scenario 14-4,which of the following

Q138: With a 15 year time duration and

Q148: Referring to Scenario 13-4,the managers of the