SCENARIO 14-17

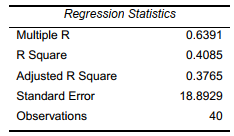

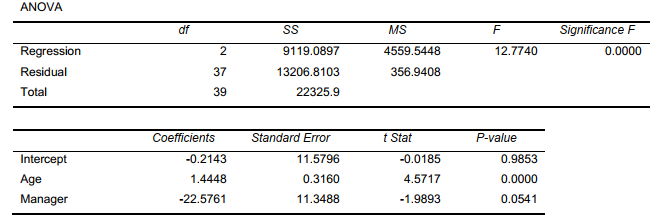

Given below are results from the regression analysis where the dependent variable is the number of weeks a worker is unemployed due to a layoff (Unemploy)and the independent variables are the age of the worker (Age)and a dummy variable for management position (Manager: 1 = yes,0 = no).

The results of the regression analysis are given below:

-Referring to Scenario 14-17,we can conclude definitively that,holding constant the effect of the other independent variables,there is not a difference in the mean number of weeks a worker is unemployed due to a layoff between a worker who is in a management position and one who is not at a 1% level of significance if all we have is the information of the 95% confidence interval estimate for the difference in the mean number of weeks a worker is unemployed due to a layoff between a worker who is in a management position and one who is not.

Definitions:

Cheap

An adjective describing products or services that are low in price, often implying lower quality or less prestige.

Differential Level Activity

Refers to changes in operating activities that result in differences in costs or revenues under different scenarios or volumes.

Activity-Based Costing

A cost accounting method that assigns overhead and indirect costs to specific activities and objects, improving the accuracy of product and service costing.

Batch Level Activity

Activities and costs associated with processing a batch of units, which occur each time a batch is handled or processed, regardless of the number of units in the batch.

Q3: Referring to Scenario 13-3,suppose the director of

Q38: For time intervals exceeding one year and

Q55: Referring to Scenario 15-6,what is the value

Q72: Referring to Scenario 16-14,the best interpretation of

Q87: Referring to Scenario 13-2,what is the coefficient

Q131: Referring to Scenario 14-10,the multiple regression model

Q157: Referring to Scenario 13-10,what are the degrees

Q197: Referring to Scenario 13-3,the total sum of

Q206: Referring to Scenario 13-9,the estimated change in

Q306: A physician and president of a Tampa