SCENARIO 15-6

Given below are results from the regression analysis on 40 observations where the dependent variable is the number of weeks a worker is unemployed due to a layoff (Y)and the independent variables are the age of the worker (X1),the number of years of education received (X2),the number of years at the previous job (X3),a dummy variable for marital status (X4: 1 = married,0 = otherwise),a dummy variable for head of household (X5: 1 = yes,0 = no)and a dummy variable for management position (X6: 1 = yes,0 = no).

The coefficient of multiple determination ( R 2j )for the regression model using each of the 6 variables X j as the dependent variable and all other X variables as independent variables are,respectively,

0.2628,0.1240,0.2404,0.3510,0.3342 and 0.0993.

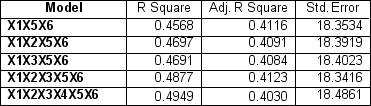

The partial results from best-subset regression are given below:

-Referring to Scenario 15-6,what is the value of the Mallow's Cp statistic for the model that includes X1,X2,X5 and X6?

Definitions:

Black-Scholes Formula

A mathematical model used to estimate the price of European-style options, considering factors like the asset's price, time, volatility, and risk-free rate.

Straight Bond Value

The value of a bond that does not have any embedded options such as convertibility or callability, calculated based on its coupon payments and maturity value.

Conversion Price

The predetermined price at which convertible security, such as a convertible bond or preferred stock, can be converted into a specified amount of common stock.

Coupon

The annual interest rate paid on a bond, expressed as a percentage of the face value.

Q2: Are Japanese managers more motivated than American

Q40: Referring to Scenario 14-4,one individual in the

Q84: Referring to Scenario 18-9,what is the correct

Q105: Successful implementation of a regression tree requires

Q107: The result of the regression tree is

Q111: Referring to Scenario 16-4,a centered 5-year moving

Q129: To assess the adequacy of a forecasting

Q136: Referring to Scenario 14-15,which of the following

Q187: Referring to Scenario 14-5,what is the p-value

Q274: Referring to Scenario 18-4,the value of adjusted