SCENARIO 16-9

Given below are EXCEL outputs for various estimated autoregressive models for a company's real operating revenues (in billions of dollars) from 1989 to 2012.From the data,you also know that the real operating revenues for 2010,2011,and 2012 are 11.7909,11.7757 and 11.5537,respectively.

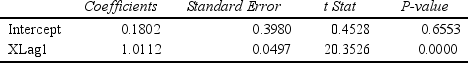

First-Order Autoregressive Model:

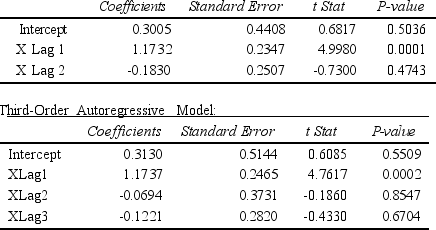

Second-Order Autoregressive Model:

Second-Order Autoregressive Model:

-Referring to Scenario 16-9,if one decides to use the Third-Order Autoregressive model ,what will the predicted real operating revenue for the company be in 2014?

Definitions:

Short Run

A period of time during which at least one of a firm's inputs is fixed, allowing for only some adjustments to production or capacity.

Personalized Sweaters

Custom-made sweaters that are tailored to an individual's preferences, often featuring unique designs, colors, or monograms.

Monopolistically Competitive

A market structure in which many firms sell products or services that are similar but not identical, allowing for competition on factors other than price.

Long Run

A period in which all factors of production and costs are variable, allowing for adjustments in production processes.

Q28: Which of the following is NOT one

Q93: Each observation is treated as its own

Q96: Referring to Scenario 14-7,the department head wants

Q105: Referring to Scenario 14-8,the analyst wants to

Q119: Referring to Scenario 18-8,what is the value

Q126: Referring to Scenario 16-13,what is the p-value

Q128: Referring to Scenario 14-17,estimate the mean number

Q163: Referring to Scenario 18-3,the analyst wants

Q188: Referring to Scenario 18-8,estimate the mean percentage

Q210: Referring to Scenario 18-2,what are the