SCENARIO 16-9

Given below are EXCEL outputs for various estimated autoregressive models for a company's real operating revenues (in billions of dollars) from 1989 to 2012.From the data,you also know that the real operating revenues for 2010,2011,and 2012 are 11.7909,11.7757 and 11.5537,respectively.

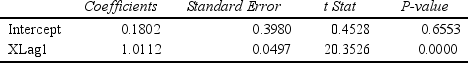

First-Order Autoregressive Model:

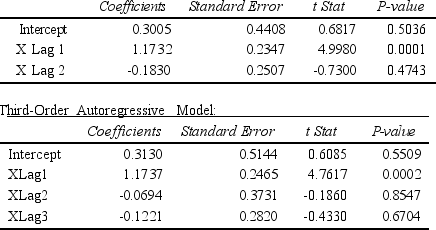

Second-Order Autoregressive Model:

Second-Order Autoregressive Model:

-Referring to Scenario 16-9,if one decides to use the Third-Order Autoregressive model ,what will the predicted real operating revenue for the company be in 2015?

Definitions:

Temporary Difference

Refers to the differences that arise between the tax base of an asset or liability and its carrying amount in the financial statements, which will result in taxable or deductible amounts in future years.

Interest On Municipal Bonds

The periodic payments made to investors of municipal bonds, often exempt from federal and sometimes state and local taxes.

MACRS Depreciation

Modified Accelerated Cost Recovery System, a method of depreciation for tax purposes in the United States that allows a faster write-off of assets.

Product Warranty Expenses

Product warranty expenses are costs that a company anticipates and records for potential future claims on warranties provided for their products.

Q9: Most information design specialists prefer bullet graphs

Q14: An interaction term in a multiple regression

Q19: Referring to Scenario 15-6,what is the value

Q23: In multidimensional scaling,the stress statistic is used

Q32: Referring to Scenario 18-9,what is the p-value

Q57: Some business analytics involve starting with many

Q59: Referring to Scenario 16-5,the number of arrivals

Q95: Referring to Scenario 18-8,the alternative hypothesis

Q135: Referring to Scenario 16-4,a centered 3-year moving

Q236: Referring to Scenario 14-2,an employee who took