SCENARIO 16-13

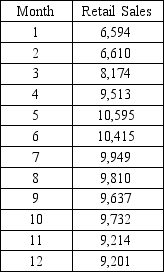

Given below is the monthly time series data for U.S.retail sales of building materials over a specific year.

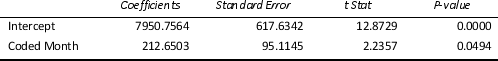

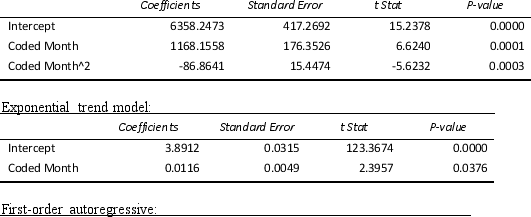

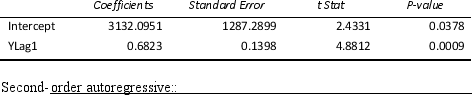

The results of the linear trend,quadratic trend,exponential trend,first-order autoregressive,second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the 1st month is 0:

The results of the linear trend,quadratic trend,exponential trend,first-order autoregressive,second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the 1st month is 0:

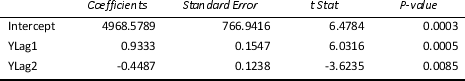

Linear trend model:

Quadratic trend model:

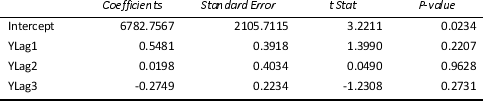

Third-order autoregressive::

Third-order autoregressive::

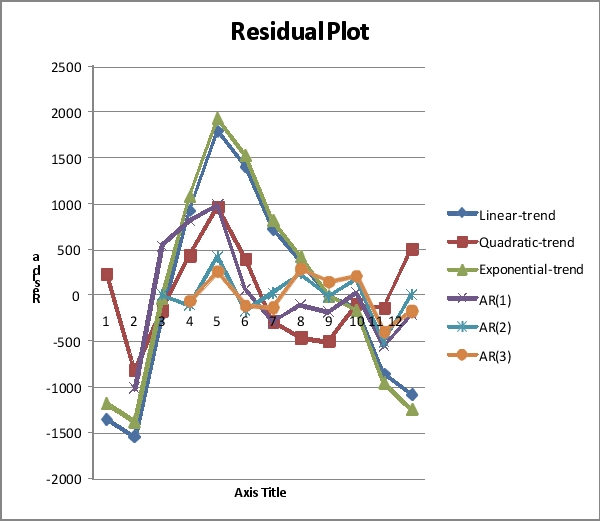

Below is the residual plot of the various models:

-Referring to Scenario 16-13,you can conclude that the third-order autoregressive model is appropriate at the 5% level of significance.

Definitions:

Amortization

The process of spreading the cost of an intangible asset over its useful life.

Investing Activities

Financial actions related to acquiring or disposing of long-term assets and investments, a component of a company's cash flow statement.

Indirect Method

A technique used in cash flow statements to convert net income into net cash flow from operating activities, by adjusting for non-cash transactions.

Direct Method

A cash flow statement approach that involves listing all major operating cash receipts and payments to calculate net cash from operating activities.

Q20: Referring to Scenario 14-4,the value of the

Q22: One of the consequences of collinearity in

Q22: The G <sup>2</sup><br>statistic is a measure of

Q53: Referring to Scenario 17-3,the highest probability of

Q86: Referring to Scenario 13-12,predict the amount of

Q88: Referring to Scenario 19-3,suppose the analyst constructs

Q99: Referring to Scenario 14-2,for these data,what is

Q101: Referring to Scenario 18-1,one individual in the

Q108: To test the effectiveness of a business

Q273: A manager of a product sales group