SCENARIO 16-9

Given below are EXCEL outputs for various estimated autoregressive models for a company's real operating revenues (in billions of dollars) from 1989 to 2012.From the data,you also know that the real operating revenues for 2010,2011,and 2012 are 11.7909,11.7757 and 11.5537,respectively.

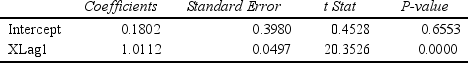

First-Order Autoregressive Model:

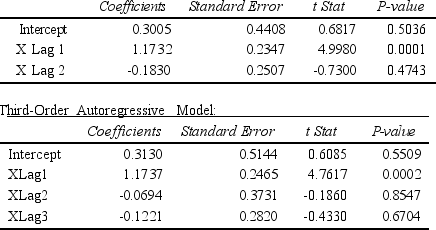

Second-Order Autoregressive Model:

Second-Order Autoregressive Model:

-Referring to Scenario 16-9,if one decides to use the Third-Order Autoregressive model ,what will the predicted real operating revenue for the company be in 2014?

Definitions:

Cash Flows

The overall volume of capital moving into and exiting a corporation, notably impacting its cash flow.

Interest Rates

The cost of borrowing money, usually expressed as a percentage of the amount borrowed, paid over a specific period.

Future Dollars

Money that is adjusted for anticipated inflation or deflation, representing its expected future value rather than its current value.

Fixed Costs

Costs that do not vary with the level of output or sales, such as rent, salaries, and insurance premiums.

Q3: Referring to Scenario 16-14,using the regression equation,which

Q26: Referring to Scenario 14-4,what are the regression

Q59: Referring to Scenario 16-5,the number of arrivals

Q74: A regression had the following results: SST

Q109: Four surgical procedures currently are used

Q121: Referring to Scenario 14-8,the value of the

Q142: Referring to Scenario 14-1,if an employee who

Q151: A zero population correlation coefficient between a

Q187: Referring to Scenario 18-11,what is the estimated

Q212: Referring to Scenario 18-8,there is sufficient evidence