SCENARIO 16-13

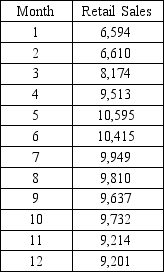

Given below is the monthly time series data for U.S.retail sales of building materials over a specific year.

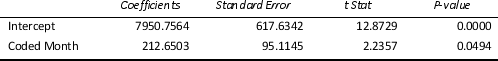

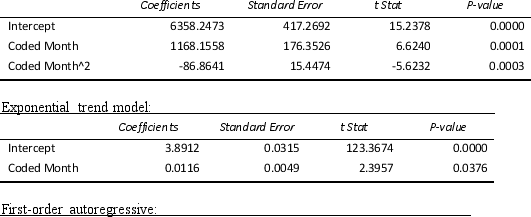

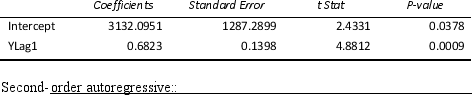

The results of the linear trend,quadratic trend,exponential trend,first-order autoregressive,second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the 1st month is 0:

The results of the linear trend,quadratic trend,exponential trend,first-order autoregressive,second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the 1st month is 0:

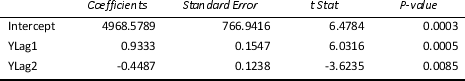

Linear trend model:

Quadratic trend model:

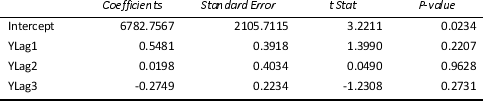

Third-order autoregressive::

Third-order autoregressive::

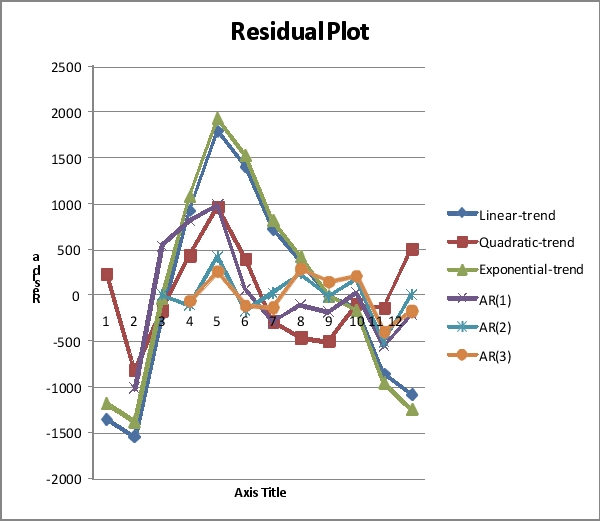

Below is the residual plot of the various models:

-Referring to Scenario 16-13,if a five-month moving average is used to smooth this series,what would be the first calculated value?

Definitions:

Guaranteed Underwriting

A promise by an underwriter to purchase all unsold shares in an offering, ensuring that the issuing company raises the full capital.

Underwriter Risk

The risk that an underwriter of securities, such as stocks or bonds, faces when guaranteeing the sale of securities to the public.

Rights Offering

A method for companies to raise capital by offering new shares to existing shareholders under specific terms and usually at a discount.

Share Price

The current price at which a particular share of stock can be bought or sold.

Q58: In multiple regression,the _ procedure permits variables

Q62: Referring to Scenario 17-3,what percentage of the

Q75: Referring to Scenario 14-5,what is the p-value

Q75: A political pollster randomly selects a sample

Q77: Referring to Scenario 16-13,the best model based

Q86: Referring to Scenario 14-15,you can conclude

Q160: Referring to Scenario 14-1,for these data,what is

Q166: Referring to Scenario 16-3,if a three-month moving

Q225: Referring to Scenario 14-15,the alternative hypothesis

Q313: Referring to Scenario 18-5,to test the