SCENARIO 16-13

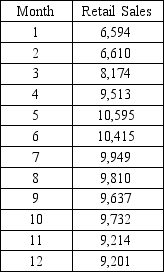

Given below is the monthly time series data for U.S.retail sales of building materials over a specific year.

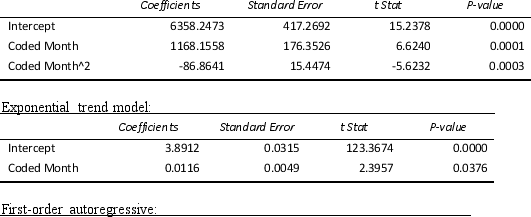

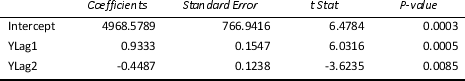

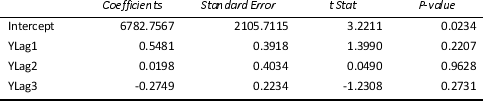

The results of the linear trend,quadratic trend,exponential trend,first-order autoregressive,second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the 1st month is 0:

The results of the linear trend,quadratic trend,exponential trend,first-order autoregressive,second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the 1st month is 0:

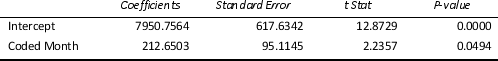

Linear trend model:

Quadratic trend model:

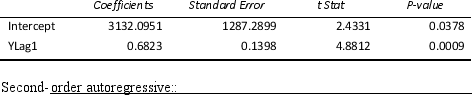

Third-order autoregressive::

Third-order autoregressive::

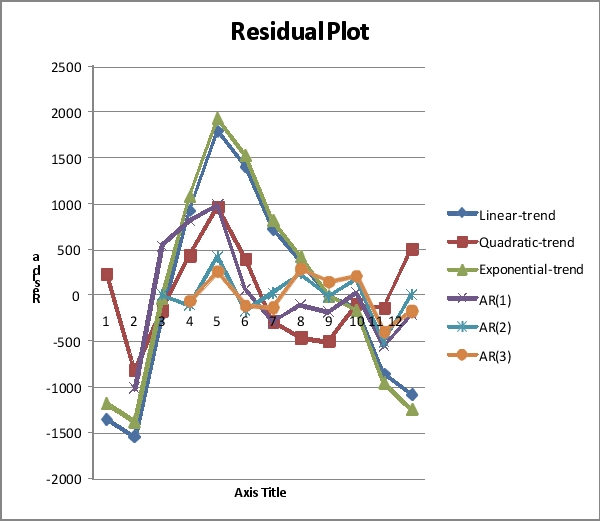

Below is the residual plot of the various models:

-Referring to Scenario 16-13,you can conclude that the quadratic term in the quadratic-trend model is statistically significant at the 5% level of significance.

Definitions:

Debt Financing

A method of raising capital through the sale of bonds, bills, or notes to individual and/or institutional investors, in return for lending the company money.

Operating Leverage

A measure of how revenue growth translates into growth in operating income, indicating the proportion of fixed versus variable costs a company has.

ROCE

Return on Capital Employed (ROCE) is a financial ratio that measures a company's profitability in terms of the capital it uses.

ROE

Return on Equity; a measure of financial performance calculated by dividing net income by shareholders' equity, indicating how much profit a company generates with the money shareholders have invested.

Q37: Which of the following is used to

Q40: Referring to Scenario 14-4,one individual in the

Q47: Which of the following regression procedures are

Q49: The interpretation of the slope is different

Q82: Referring to Scenario 16-4,exponential smoothing with a

Q109: Referring to Scenario 14-4,which of the following

Q123: Referring to Scenario 16-3,if this series is

Q145: Referring to Scenario 14-3,what is the predicted

Q217: Referring to Scenario 14-17,what is the p-value

Q282: Every spring semester,the School of Business coordinates