SCENARIO 17-4

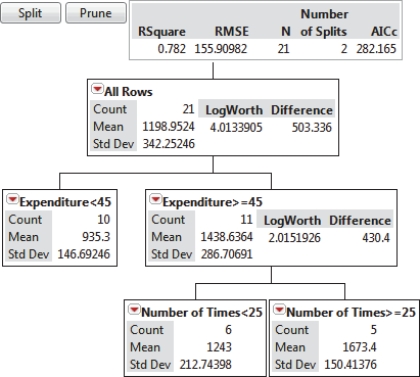

The regression tree below was obtained for predicting the weekend box office revenue of a newly released movie (in thousands of dollars)based on data collected in different cities on the expenditure (at $25,$30,$35,$40,$45,$50,$55,$60,$65 or $70 thousand)spent on TV advertising and the number of times (10,15,20,25,30 or 35)a day the advertisement appear on TV.

-Referring to Scenario 17-4,the first split occurs at 25 TV appearances a day of the advertisement.

Definitions:

Basis of Stock

The original value of an asset for tax purposes, usually the purchase price, which is used to calculate capital gains or losses when the stock is sold.

Contributed Property

Property or assets given to a partnership or corporation by an owner or shareholder, often impacting the basis of the investment.

Shareholder

An individual or entity that owns shares in a corporation and therefore has ownership interest in the company.

Book Income

The income of a business reported in its financial statements, different from taxable income reported to the IRS.

Q2: Which of the following is not an

Q18: Referring to Scenario 15-6,what is the value

Q23: In multidimensional scaling,the stress statistic is used

Q31: Referring to Scenario 17-2,the Asia Pacific region

Q41: Referring to Scenario 16-5,the number of arrivals

Q74: A regression had the following results: SST

Q99: Each observation is treated as its own

Q102: The manager of a company believed that

Q146: Referring to Scenario 19-7,what percentage of the

Q311: Referring to Scenario 18-9,the errors (residuals)appear to