SCENARIO 17-1

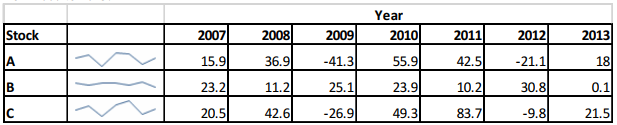

The table below contains the sparklines for the rates of return (in percentage)for three different stocks from 2007 to 2013.

-Referring to Scenario 17-1,the sparklines enable you to predict that the rates of return of the stock market in 2014 will be higher than in 2013.

Definitions:

Residuals

The differences between observed values and the values predicted by a statistical model, indicating the model's accuracy.

Fitted Values

Predicted values calculated from a model that represent the estimated response given the predictors.

Simple Linear Regression

A statistical method that models the relationship between two variables by fitting a linear equation to observed data.

Confidence Interval

An estimate of an interval in statistics that likely contains a population parameter, providing a range of plausible values for that parameter.

Q63: A certain type of rare gem serves

Q76: Referring to Scenario 14-5,what are the predicted

Q102: The manager of a company believed that

Q104: Referring to Scenario 17-4,the highest mean weekend

Q127: If the percentage differences between consecutive values

Q132: Referring to Scenario 19-3,suppose the analyst constructs

Q174: Referring to Scenario 14-5,what fraction of the

Q180: Referring to Scenario 14-7,the department head

Q197: Referring to Scenario 18-10 Model 1,_of the

Q198: Referring to Scenario 18-10 Model 1,which