SCENARIO 17-4

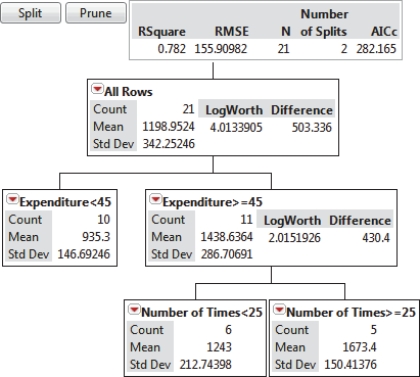

The regression tree below was obtained for predicting the weekend box office revenue of a newly released movie (in thousands of dollars)based on data collected in different cities on the expenditure (at $25,$30,$35,$40,$45,$50,$55,$60,$65 or $70 thousand)spent on TV advertising and the number of times (10,15,20,25,30 or 35)a day the advertisement appear on TV.

-Referring to Scenario 17-4,the highest mean weekend box office revenue is predicted to occur with $55 thousands spent on TV advertisement and 35 advertisement appearances a day.

Definitions:

Capital Structure

The mix of different forms of financing used by a company, such as debt, equity, and other types of financing.

Cost of Equity

The return that investors expect for providing capital to a company, often estimated using models like the Dividend Discount Model (DDM) or the Capital Asset Pricing Model (CAPM).

Unlevered Cost of Capital

Refers to the cost of capital for a firm that has no debt, representing only the cost of equity.

Q60: The parameter estimates are biased when collinearity

Q64: Some business analytics involve starting with many

Q78: Referring to Scenario 18-8,there is sufficient evidence

Q104: Referring to Scenario 18-11,there is not enough

Q113: Referring to Scenario 16-13,what is the exponentially

Q141: Referring to Scenario 18-5,the multiple regression model

Q153: Referring to Scenario 16-9,if one decides to

Q156: The control limits are based on the

Q251: The director of admissions at a

Q262: Referring to Scenario 18-10 Model 1,the