SCENARIO 18-12

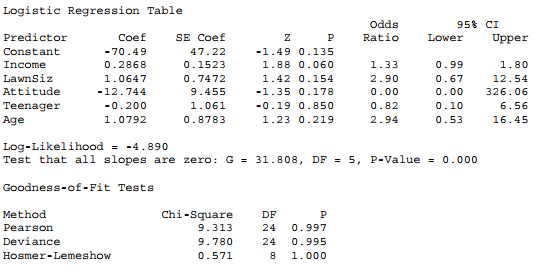

The marketing manager for a nationally franchised lawn service company would like to study the characteristics that differentiate home owners who do and do not have a lawn service. A random sample of 30 home owners located in a suburban area near a large city was selected; 15 did not have a lawn service (code 0) and 15 had a lawn service (code 1). Additional information available concerning these 30 home owners includes family income (Income, in thousands of dollars), lawn size (Lawn Size, in thousands of square feet), attitude toward outdoor recreational activities (Attitude 0 = unfavorable, 1 = favorable), number of teenagers in the household (Teenager), and age of the head of the household (Age). The Minitab output is given below:

-Referring to Scenario 18-12,there is not enough evidence to conclude that the model is not a good-fitting model at a 0.05 level of significance.

Definitions:

Support

Assistance or help provided by an individual or system to address a need or solve a problem.

Dependency Exemption

A tax exemption for a taxpayer who supports another generally based on kinship, amount of support, and income levels (Note: Under tax law changes, this may not apply for certain tax years).

Qualifying Relative's Support

Expenses that contribute to more than half of a qualifying relative's total support for the year, impacting eligibility for certain tax benefits.

Dependency Exemption

A tax deduction allowed for a taxpayer to claim for those who depend on the taxpayer's financial support, such as children or relatives, reducing taxable income.

Q13: Which of the following is NOT among

Q17: Referring to Scenario 18-10 Model 1,what is

Q54: The _ curve represents the expected monetary

Q69: Total Productive Maintenance focuses on preventing the

Q78: Which of the following is true regarding

Q79: Referring to Scenario 17-6,what is the r-square

Q86: Referring to Scenario 20-6,what is the maximum

Q129: The Paasche price index has the disadvantage

Q245: Referring to Scenario 18-10 and using both

Q260: A Paso Robles wine producer wanted to