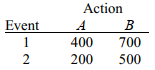

SCENARIO 20-2

The following payoff matrix is given in dollars.

Suppose the probability of Event 1 is 0.5 and Event 2 is 0.5.

-Referring to Scenario 20-2,the return to risk ratio for Action B is

Definitions:

Price-earnings Ratio

A financial metric that measures a company's market share price relative to its earnings per share, indicating investor sentiment about future earnings.

Times

A financial metric used to compare two quantities or to indicate frequency. In business, it often refers to multiples or ratios used in financial analysis.

Total Assets

The sum of all assets owned by an entity, representing the total resources at its disposal.

Total Liabilities

The cumulative amount of all debts and financial obligations a company owes to outside parties.

Q25: Quick Changeover Techniques establish ways to clean

Q32: Referring to Scenario 18-9,what is the p-value

Q37: A company with $60,000 in current assets

Q42: Variation signaled by individual fluctuations or patterns

Q88: Referring to Scenario 20-5,what is the return

Q93: Referring to Scenario 19-9,an R chart is

Q121: A disadvantage of the indirect method of

Q129: Assets that are held for sale as

Q190: To construct bootstrap confidence interval estimate

Q196: Referring to Scenario 18-8,there is sufficient evidence