SCENARIO 20-5

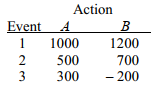

The following payoff table shows profits associated with a set of 2 alternatives under 3 possible events.

Suppose that the probability of Event 1 is 0.2,Event 2 is 0.5,and Event 3 is 0.3.

-Referring to Scenario 20-5,what is the EMV for Action A?

Definitions:

Trade Creditors

Suppliers or vendors that allow businesses to buy goods or services on account, paying them at a later date.

Flexible Lending Arrangements

Financial agreements that offer adaptable repayment terms to accommodate the borrower's financial situation.

Asset-Based Lending

A type of financing where loans are given based on the value of an individual's or company's assets.

Loan Collateral

Assets or property pledged by a borrower to secure a loan, serving as a guarantee for the lender that the loan will be repaid.

Q29: Referring to Scenario 9-11,if you select a

Q50: Referring to Scenario 19-7,an x̄ chart is

Q81: Under the indirect method, an increase in

Q85: Referring to Scenario 9-13,if you select a

Q107: The gain (loss) on disposal of a

Q118: An assessment of liquidity can be done

Q138: The C<sub>pk</sub> is a one-sided specification limit.

Q179: Referring to Scenario 18-10 Model 1,what is

Q210: Referring to Scenario 18-2,what are the

Q230: To construct a bootstrap confidence interval