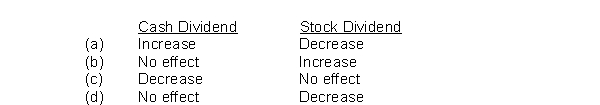

Identify the effect the declaration of a cash dividend and a stock dividend has on the total shareholders' equity of a corporation:

Definitions:

Taxable Income

The amount of income used to calculate how much tax an individual or a company owes to the government in a specific tax year.

Warranty Expenses

Costs associated with the obligation to repair or replace products that fail to meet specified standards.

Interperiod Tax Allocation

The process of distributing the tax effects of transactions over various accounting periods.

Warranty Expenses

Costs incurred by a company for repairing, replacing, or servicing products under warranty, recognized as a liability at the time of sale.

Q25: The times interest earned ratio is calculated

Q26: Under IFRS, the receipt of dividends from

Q33: The depreciation expense for 2012 using the

Q51: An asset that cannot be sold separately

Q63: Which of the following items does not

Q72: On January 1, 2013, Cornwall Corp purchased

Q83: Which of the following shows the proper

Q92: The cost of a depreciable long-lived asset

Q97: Valuing available-for-sale securities at fair value could

Q105: Coombs Corp. declared a two-for-one stock split.